Global Notebook Shipments to Grow 2.2% in 2025 as Southeast Asia Production Capacity Expands, Says TrendForce

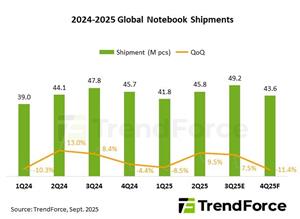

TAIPEI, Taiwan, Sept. 17, 2025 (GLOBE NEWSWIRE) -- Despite challenges from geopolitical tensions and tariff uncertainties, the global notebook market is showing signs of recovery in 2025. TrendForce reports that notebooks currently continue to enjoy U.S. tariff exemptions when imported from Southeast Asia. Combined with earlier supply chain relocation to the region in response to U.S. tariff measures under the Trump administration, production capacity has now gradually come online. This will help drive notebook shipments to grow by 2.2% YoY in 2025, surpassing 180 million units.

Quarterly momentum highlights a particularly strong 2Q25. On one hand, brands accelerated shipments as notebooks manufactured in Southeast Asia continued to enjoy zero tariffs when exported to the U.S. On the other hand, China’s subsidy policies fueled a replacement cycle, while Japan’s GIGA School 2.0 education initiative continued to boost demand, leading to 9.5% QoQ shipment growth.

In 3Q25, even as the U.S. has yet to announce details on semiconductor tariffs, notebooks remain exempt. With brands, OS vendors, and CPU suppliers continuing to support channels through subsidies, shipments are expected to remain positive with 7.5% QoQ growth.

Southeast Asia production capacity in the spotlight

Southeast Asia has emerged as the primary notebook production base outside of China as global supply chains undergo restructuring. Dell and Apple’s large-scale investments in Vietnam have catalyzed the formation of a supply chain cluster, attracting additional brands to expand there.

Thanks to its proximity to China, convenient logistics, stable policy environment, and young labor force, major ODMs such as Compal, Wistron, LCFC, and Huaqin have all prioritized Vietnam for capacity expansion. TrendForce forecasts that Vietnam’s share of global notebook production will rise rapidly to 13.5% in 2025.

In Thailand, HP has taken the lead, working with Quanta and Inventec to establish new production lines. With a foundation in electronics manufacturing, government incentive policies, and a strategic geographic position connecting South Asia and ASEAN markets, Thailand is emerging as another key node. The country’s share of global notebook capacity is expected to reach 6.7% in 2025 as more component suppliers move in and the supply chain matures.

Beyond Vietnam and Thailand, education and government procurement programs in several regions require notebooks to be locally manufactured, encouraging brands to localize production in large domestic markets. Partnerships with local manufacturers in India, Indonesia, and Brazil are building additional capacity. While scale is still limited, these efforts are becoming an important lever for market penetration. TrendForce estimates that such localized capacity will account for 3.7% of global notebook production in 2025.

TrendForce concludes that on the demand side, global notebook shipments in 2025 will be supported by steady replacement cycles and education projects. On the supply side, production diversification driven by capacity relocation and geopolitical considerations will accelerate. Southeast Asia is set to become the next critical manufacturing hub, playing a key role in mitigating trade risks.

For more information on reports and market data from TrendForce’s Department of Display Research, please click here, or email the Sales Department at DR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

About TrendForce

TrendForce is a global provider of the latest development, insight, and analysis of the technology industry. Having served businesses for over a decade, the company has built up a strong membership base of 500,000 subscribers. TrendForce has established a reputation as an organization that offers insightful and accurate analysis of the technology industry through five major research divisions: Semiconductor Research, Display Research, Optoelectronics Research, Green Energy Research, ICT Applications Research. Founded in Taipei, Taiwan in 2000, TrendForce has extended its presence in China since 2004 with offices in Shenzhen and Beijing.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3eea4f82-026c-4beb-bdfd-b5982cbc3df5

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.